There is a sea change coming in the character of Europe’s energy over the next decade. Nearly all those states with coasts on the Atlantic and North Seas are actively promoting floating offshore wind (FLOW) projects. Across the Western European Coastline, there are currently 42 FLOW projects licensed or at auction stage which will have 33GW of generating capacity.

The map left shows where these are, and the table below gives details on Project Name, location, capacity in MW, identity of the owner/partners and, the project’s current status.

These are the projects that have been licensed, currently at auction or pending auction. All would be expected to be operational 2029-2032. The list shows all of the main European Renewable Energy, Offshore Energy and Utility Companies are engaged in FLOW project expected to start building 2026-2028 and be commissioned by 2032.

Table 1 Floating Offshore Wind Projects Atlantic and North Sea by Status (from various sources compiled by author) [Scrollable, or click here to open in new tab]

In spite of this, Irish government policy makers at all levels, including the highest, continue to state that FLOW is not technically ready and won’t be for years. What does the Irish government know that nobody else does?

Before we get on to that ‘technical’ question though, let’s just see what the effect of this assessment is.

Just what is lost by the Irish people by their government’s sceptical approach?

Table 2 below shows the returns to the UK exchequer from the Round 4 Auction of offshore renewable energy licenses. Note: The projects were all fixed bed projects (unlike the 33GW of projects shown in Table 1).

Table 2: 1 England and Wales’ Crown Estates Revenue from Round 4 Auction [scrollable left to right, or click here to open in a new tab]

The table shows the fees charged by the UK government to successful applicants in the auction process. These are the option fees being paid annually by six UK projects to the UK state via the Crown Estates. Round 4 concluded in January 2023. While these projects are fixed bed, they give an indication of where the price could be in the English and Welsh FLOW auction Round 5 which was launched 28 February 2024.

So, the cost per MW charged by the Crown Estates for FLOW will be probably less than what they are charging the projects listed in Table 2. This is because the cost of installing, and maintenance of FLOW will be more than fixed bed. The fees will be less than GBP £108k/MW, but not by a huge amount. But in any case, the fees will be determined by the projects’ willingness to pay through a competitive bidding process.

So now we know FLOW projects are willing to pay our near neighbour €125k (per year) for each MW of fixed bed offshore.

In Ireland, there are at least 17 projects who are seeking licences for FLOW off the Irish West Coast. These are listed below in Table 3. You’ll notice that it is suggested that these are being promoted by some fairly experienced players in wind – offshore and onshore. The ESB and Mainstream Renewable Power are there in Table 3, but they are also there in Table 1 with very large FLOW projects in Scotland. The ESB has a license for a 100MW FLOW project off the Coast of Derry/Donegal – but just North of Irish Waters, instead in those of Scotland.

Table 3: Irish Floating Offshore Licence Applications: Not all are still active since the Irish government applied a DMAPs approach [Scrollable or click here to open in a new tab]

Just as a hypothetical exercise, we could apply a generous 25% reduction to the UKs fixed bed offshore licence charges. We’d then arrive at an estimation of what the Irish state’s direct fee revenue could be from the 17 listed FLOW projects above. The figure would be €1.95bn – every year. Potentially from now, or whenever the government decided to start accepting licences/bid at auction. That is a lot of money.

So: the Irish State has turned down up to €1.95bn in option fees per year since 2022 by putting obstacles in the way of floating offshore wind projects on the West Coast. At its current pace of policy inaction, it could lose out on €19.5bn by 2032.

It’s a bit of a shock to discover that somehow, by perusing an approach no other European country agrees with, Irish policy is to push back work on FLOW here. Costing us environmentally, reputationally, and socially – but it also costs us financially.

Why could that be?

There are numerous statements being made about the unusual qualities of the sea conditions in the Irish Atlantic.

So, let’s look at that, then.

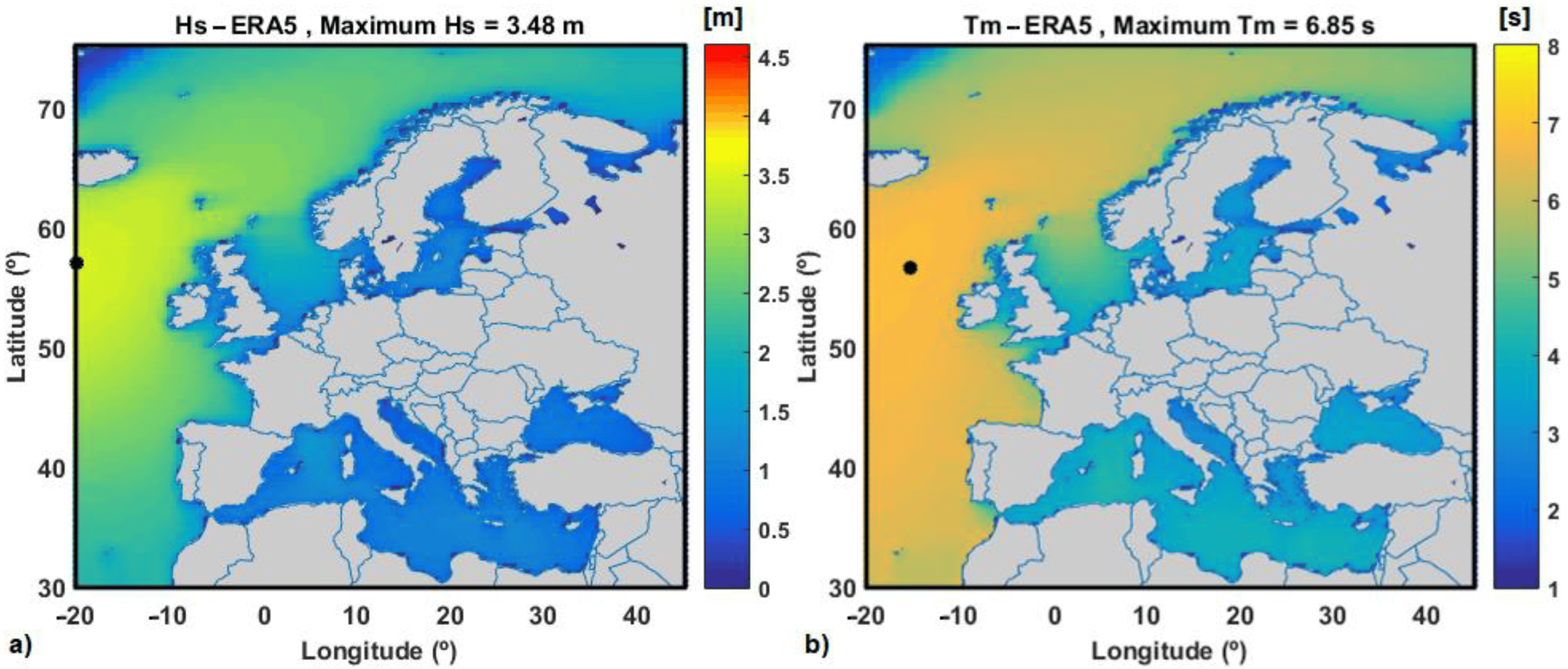

Figure 2: Mean wave conditions for the Europe region in the period 2001–2020: (a) Wave heights; (b) Wave periods. SOURCE

In Figure 2, you can see that the conditions off the West Coast of Ireland are indeed rougher than those off the coast of Wales: no surprise there. But clearly, zooming in (Figure 3)

Figure 3: Detail from Figure 2: Mean wave conditions for the Europe region in the period 2001–2020

Figure 4: Licensed or Auctioned Sites FLOW (see above)

We see that the FLOW projects at auction or already licensed off Portugal, or in the Bay of Biscay, or off the North Coast of Scotland, or around Shetland and Orkney, have similar conditions to Ireland’s West Coast.

So it can’t be that. In any case, we already saw that technical studies by at least one highly experienced offshore wind company showed Ireland’s West Coast as suitable to it’s FLOW designs. I’m sure that there are other developers that will say likewise (ESB? Mainstream?) in Scotland at least.

What could be the real reason for Irish state scepticism?

Maybe the idea that an acceptance that FLOW is technically feasible, environmentally beneficial, and financially very valuable to the state could affect how non-FLOW projects could be seen on the East Coast?

If that was the case, then the West Coast’s social and economic future would be being used as tools in an East coast policy game. Ireland’s FLOW opportunity would be being surrendered for non-technical and very East coast political reasons.

But that could never happen…

Notes, References and Resources

Scotwind First round of leasing options

Scotwind Second round of leasing options

Crown Estates England and Wales PDAs 1, 2 and 3

Crown Estates England and Wales Round 5: FLOW

France appoints builder of first commercial-scale floating wind farm in Brittany (15th May 2024)

San Cibrao Floating Offshore Wind Project, Spain

CIP Reveals Plans to Invest EUR 8 Billion in Wind Project Offshore Portugal